What does APR mean in Loans?

What Does APR Mean In Loans?

Have you heard the famous Chinese proverb ‘Timely return of a loan makes it easier to borrow a second time’?

Before you apply for a loan in the United Kingdom, you should know about the basic terminologies such as APR. Your heart desires to buy the latest car! Staying on rent is great for those who are the sole owners in their home, but buying your own home is even better! Did you know buying a home is cheaper than paying rent every month? You can build your dream home or buy a pretty apartment by taking a loan. Your child wishes to study in another country and a student loan is recommended.

The question is – Do you understand everything about a loan? Think hard!

Just take a few minutes to understand the concept of APR in loans. This is extremely important. Isn’t it better to be fully armed with in-depth information?

Here’s a post that talks about the meaning of APR in loans. Before you make the decision of taking a loan, read this fully and then move forward.

Understanding APR – The Beginning

As soon as you apply for a loan, you will come across new technical jargon. APR is one of those terms which you will come across when applying for a loan.

APR is basically an ANNUAL PERCENTAGE RAGE. It refers to the total amount you have borrowed annually. This includes the interest and the fee that you will be paying in a year.

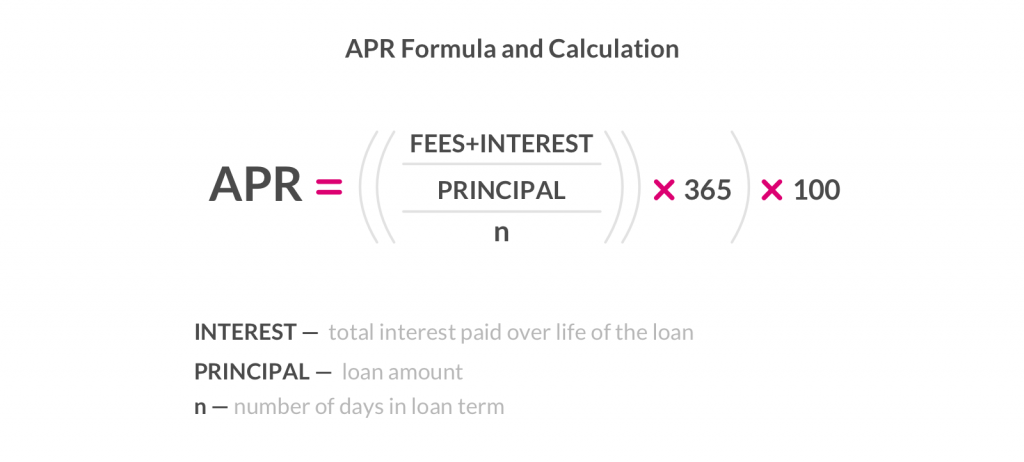

As a novice, you must be wondering how one calculates the APR. We have mentioned the solution right below:

The above-mentioned formula helps to calculate the APR you will be paying to the lender. In this case, simple interest is calculated and not compound interest.

The APR in a loan is none other than the interest rate that you will be paying. It does not include compounding. APR only takes into account the simple interest. Also, the borrowers demand to see the APR figure while they are comparing the mortgage rate or the credit card rate. This also includes all the up-front charges or any other charges.

In simple words, APR is what the moneylender charges on the money borrowed by you. It is charged on a yearly basis.

The lenders offer you a loan on the basis of your credit score, gross income, credit report, etc. The origination fee can differ from one lender to another.

Please note that APY or Annual Percentage Yield is different from APR. We will note down the differences in the next section. Before that, please understand why you must understand the concept of APR.

Why is APR important for personal loans?

Let us say you head to two different lenders. One is offering an origination fee of 3% and the other is charging 2%. The interest rate for the former is 10% and the other is 11%. It gets difficult for you to differentiate which one is cheaper! In comes the APR. The former gives you 11.6% APR and the latter gives you 12.1%.

This is the differentiator! You will naturally opt for the former one. This is where the difference is. APR is important in personal loans!

As per experts, choose a lender who offers a lower APR. This will be much more economical for you!

Basically, APR will be the outlay of borrowing money from the lender. When you are taking a loan, look at three important things –

- The interest rate

- Loan fee/origination fee

- APR

Most importantly, you must choose a lender who is able to explain the terms to you clearly. While checking the APR and interest rate are basic do’s, but the lender should be legit and clear too.

If the lender is not the right entity, you could land up in different types of issues later on. Hence, at LendShop, you get to meet legit lenders who are here to help you monetarily.

APR V/s APY

APR is the yearly rate and it does take into account the compound interest. APY takes into account the compound interest. Also, the APY will be higher as compared to the APR.

APY will be the actual rate of return on any investment you make for a year.

Interest Rate V/s APR

Please do not get confused between the two terms. APR and interest rates are different from each other. You took $15000 from a lender and the interest rate is 10%. You will be paying the same 10% each month. To top it up, you will also be paying the principal payment.

The APR includes all the commercials/expense that you are taking care of. It also includes the interest rate.

The APR can also include the following –

- Loan application charge

- Origination fee

- Fee for underwriting

- Loan processing charge

- Document prep charge

Speak to the lender and understand all the terms. You can speak to different lenders and compare the APR. How do you know the API?

There are two ways here – either ask the lender or use the API calculator.

Kindly note that a lender is supposed to tell you the APR. If they are not doing so, then you are dealing with an untrustworthy entity. A reputable lender will tell you the APR and not hide the fees.

The first step before you apply for a loan is to know the APR.

Concluding Thoughts

We hope that you gained some knowledge on the ANNUAL PERCENTAGE RATE. This is just to inform you that any lender who is ready to lend money to you will provide you with an APR. Do not deal with them if they do not provide it!

Always choose a reliable lender who does not hide any fees. They should be able to explain to you the terms clearly.

So, make a wise decision and choose a lender from our reliable platform!

We are just a medium through which you meet trustworthy and reputed lenders in the United Kingdom.